CCMA course describes the management accounting concepts and familiarizes the cost control techniques viz., budgetary control, standard costing, variance analysis, marginal costing technique and break even analysis. This imparts comprehensive understanding about the financial statement analysis acquiring knowledge on financial ratios viz. short term solvency, long term solvency, profitability ratios. This provides knowledge on concept of fund, funds flow and cash flow enabling preparation of statement of sources and application of funds and cash flow statements.

- Teacher: Dr. KUSUMA REDDY C

The General English course English Express caters to the needs of students who embark on

a new journey after their undergraduate studies. During the course of the previous

semesters, the students got exposure to experiential learning, especially with live projects

and campus interviews, and the English course prepares them to face these challenges. All

the texts in the coursework are carefully picked to enable them to gain pragmatic

experiences of life apart from exposing them to the apparent reflections of varied human

societies and cultures. The texts also enable them to think critically and comprehend the

implicit values they convey.

- Teacher: Dr RAJITA ANAND SINGH

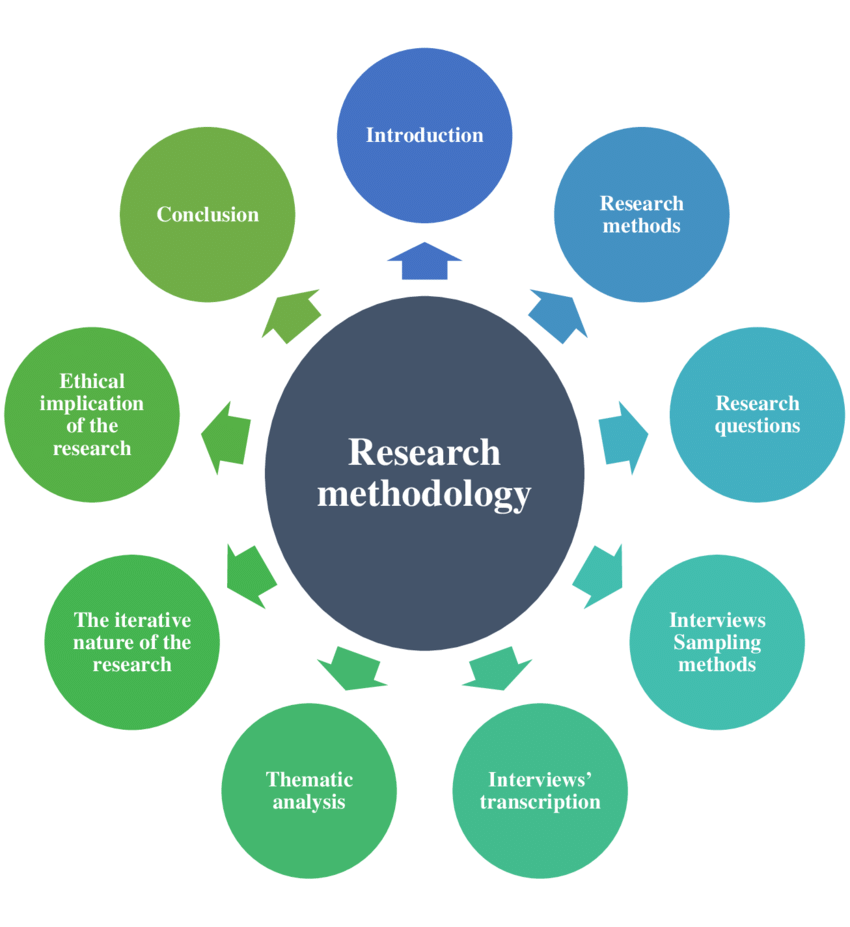

Research Methodology and Project Report deals with basic concept of research, research design and flow of research process with special emphasis on understanding levels of measurement scale of variable, framing of hypothesis. This imparts knowledge on understanding data analysis using parametric and non-parametric tests viz., t-test, F-test, chi-square test, one-way ANOVA, two-way ANOVA. This provides comprehensive insight about how a project report is prepared.

- Teacher: Dr SAJJA DEEPTHI

This course provides a comprehensive understanding of the Goods and Services Tax (GST) framework in India, covering its foundational principles, tax registration processes, invoicing, input tax credit mechanisms, and compliance requirements. Students will explore GST-related accounting practices, including recording transactions, generating GST returns, and managing input tax credits. The course emphasizes practical applications such as handling interstate and intrastate supplies, exemptions, mixed and composite supplies, and export/import transactions. Additionally, it focuses on GST implementation in ERP systems, enabling learners to set up tax rates, update masters, and manage GST compliance effectively. By the end of the course, students will gain a practical understanding of GST's implications for businesses.

- Teacher: BIKSHAPATHI MADA

COURSE DESCRIPTION:

How to identify computer system vulnerabilities, to recognize digital exploitation and also prevent damage such as loss of data, loss of money through viruses.

- Teacher: HARINI PAGADALA