Course Description: This course will enable the students to understand the current economic problems in India and highlights the important economic sectors and challenges faced by them in the recent years.

Course Objectives: To provide an overview of Indian economy and to make the student acquaint with the latest developments in the economy

Course Outcome:

CO1. To get an overview of Indian Economy.

CO2. To make the students acquainted with the latest developments in the Economy.

CO3. Students will come across with the problems and success of LPG Policy

CO4. Know the positive and negative impacts of LPG.

CO5. Students will know and understand nations problems

CO6. Learn the measures to solve the problems of the nation.

- Teacher: GISA GEORGE

COURSE OBJECTIVE:

To acquire knowledge of working of Indian banking system.

COURSE OUTCOME:

To make the students understand the fundamental principles of banking supervision and its practices in India from the regulatory perspective and the banks management aspects and familiarize the control systems in banks, so as to help the students to learn and develop the required skills to manage the banking operations effectively and efficiently.

- Teacher: PAVITRAMBIKA MANGARI

Course Description

Computerized Accounting involves using computers and accounting packages for recording storing and analyzing financial data. Tally Software is a complete accounting, inventory, taxation and payroll software. It is one of the best and most commonly used software applicable for small business houses and big financial companies. Learning of computerized accounting makes the entire process of preparing financial accounts faster and simple. The Financial Statements and reports can be generated at the click of a button. It relives the accountants from routine and time consuming process of manual accounting. Financial Data processed through accounting software is easily accessible, accurate, reliable, cost effective and secure

Course Significance:

Learning Computerized accounting is imperative for students seeking jobs in accounts department of any company. It gives the learner the required skills to carry out range of day-to-day accounting activities. Learning Tally also makes it easy to adapt to any other package designed for accounting. By learning the advanced features of Tally related to Taxation and payroll the candidates will be eligible for the posts of (in Government & Private) Assistant Clerks in Tax Departments, Junior Accountants in Companies, Corporations and Boards. Audit Assistant in co-operative departments. Office Assistant/ Accounts Clerk/Accounts Assistant/ Assistant Commercial Tax Practitioner, assistant income tax practitioner, Data Entry Operator, Entry level accounts analyst in BPO.

Course Outcomes :

CO1) This course aims at providing Computerized Accounting skills to the students.

CO2) The students will learn the procedure of transition of manual accounting to computerized accounting.

CO3) The student will gain the competence to perform all basic functions of accounting, store details and manage inventory items.

CO4) Students will be capable of using accounting software for business communication and accounting purposes.

CO5) Students will be able to account for purchases and inventory transactions (creating purchase orders, handling invoices, maintaining inventory control) using a computerized accounting software package.

CO6) Students will be able to account for customer and sales related events (maintaining and analyzing customer data, billing, bank deposits and accounts receivable) using a computerized accounting software package

CO7) Will be able to

ascertain profits and Financial position of the organization

CO8) Will be able to

generate reports like Profit and Loss statement, Balance Sheet, Trial Balance,

Cash-flow report, etc. and facilitate in decision making.

- Teacher: Dr. KAVITA THAKUR

Course Description

Computerized Accounting involves using computers and accounting packages for recording storing and analyzing financial data. Tally Software is a complete accounting, inventory, taxation and payroll software. It is one of the best and most commonly used software applicable for small business houses and big financial companies. Learning of computerized accounting makes the entire process of preparing financial accounts faster and simple. The Financial Statements and reports can be generated at the click of a button. It relives the accountants from routine and time consuming process of manual accounting. Financial Data processed through accounting software is easily accessible, accurate, reliable, cost effective and secure

Course Significance:

Learning Computerized accounting is imperative for students seeking jobs in accounts department of any company. It gives the learner the required skills to carry out range of day-to-day accounting activities. Learning Tally also makes it easy to adapt to any other package designed for accounting. By learning the advanced features of Tally related to Taxation and payroll the candidates will be eligible for the posts of (in Government & Private) Assistant Clerks in Tax Departments, Junior Accountants in Companies, Corporations and Boards. Audit Assistant in co-operative departments. Office Assistant/ Accounts Clerk/Accounts Assistant/ Assistant Commercial Tax Practitioner, assistant income tax practitioner, Data Entry Operator, Entry level accounts analyst in BPO.

Course Outcome:

CO1) This course aims at providing Computerized Accounting skills to the students.

CO2) The students will learn the procedure of transition of manual accounting to computerized accounting.

CO3) The student will gain the competence to perform all basic functions of accounting, store details and manage inventory items.

CO4) Students will be capable of using accounting software for business communication and accounting purposes.

CO5) Students will be able to account for purchases and inventory transactions (creating purchase orders, handling invoices, maintaining inventory control) using a computerized accounting software package.

CO6) Students will be able to account for customer and sales related events (maintaining and analyzing customer data, billing, bank deposits and accounts receivable) using a computerized accounting software package

CO7) Will be able to

ascertain profits and Financial position of the organization

CO8) Will be able to

generate reports like Profit and Loss statement, Balance Sheet, Trial Balance,

Cash-flow report, etc. and facilitate in decision making.

- Teacher: Dr. KAVITA THAKUR

Course descriptions:

Cost accounting is a 4 credit course with 52 sessions focusing on Basic Costing concepts, methods and techniques of Cost accounting.

Course Objective:To make the students acquire the knowledge of cost accounting methods.

Course Outcome:

CO1) Express the place and role of cost accounting in the modern economic environment

CO2) Identify the specifics of different costing methods.

CO3) Apply Costing Concepts in their business and cost related areas.

CO4) Emphasis will be placed upon the application of cost accounting theory in the

solution of problems.

CO5) Explain the similarities and differences between job order cost and process cost

systems and determine who uses each.

CO6) Apply activity-based costing to service industries.

CO7) Appear confidently for Cost Accounting based college / Professional Course

Examinations.

- Teacher: DURGA VAIDEHI G

PRACTICE OF GENERAL INSURANCE

|

Course Description: This program will broaden their knowledge of divergent practices prevalent in different insurance markets the world over and also widen their perspective of international markets. The program is a two credit course. Course Objective: To make acquaint of various types of General Insurance Products and their contribution in the economic development of a country. Course Outcomes: CO1: Students apprehend the various products and their significance of General Insurance CO2: Students know the prospects of Indian and International General Insurance Market CO3:Students realize the statutory requirements and procedure to be followed while filling the various General Insurance policy forms and documents CO4:Students will understand the role of underwriters & Actuaries in fixing the premiums by Risk Sharing and Risk Management techniques CO5: Students understand the process and documents necessary for different types of claims. CO6: Students also learn about the frauds, fraud prevention and different types of reserves of Insurance Companies |

- Teacher: HARINI PAGADALA

COURSE DESCRIPTION:

Business Law addresses statutes and regulations affecting businesses, families, and individuals in

their related roles. Knowledge of business law is useful for all students, because all students

eventually assume roles as citizens, workers, and consumers in their communities and in society at

large. As laws emanate from different governmental and judicial entities, students must have a

basic understanding of law and the foundation of the legal system to be successful in any area of

business as well as their personal lives.

Business Law is a course that is designed to give students the knowledge they need regarding a

basis of law while preparing students to make ethical, legally-minded, professional decisions

currently and in the future.

COURSE OBJECTIVE:

To make the students acquire basic conceptual knowledge of different laws relating to Business.

COURSE OUTCOMES:

CO1: Students discern the evolution of Business Law and Indian Contract Act,1872

CO2: Students knew the different types of business contracts existing under the Indian

Contract Act,1872

CO3: Students assimilate the various modes of discharge of contract

CO4: Students learn the various modes of breach of contract and remedies available

under Indian Contract Act, 1872

CO5: Students understand the difference between Contract of Sale and Agreement to sell

CO6: Students analyze the vital role of Consumer Forums at various levels in solving

consumer disputes through Consumer Protection Act

CO7: Students acquaint with the norms and procedure to register the trade Marks, Patents

and Copy Rights

CO8: Students infer the duration, renewal procedure of Trade Marks, Copy Rights, &

Patents and Copy Rights Infringement Punishments

CO9: Students learn the significance and evolution of IT Act and to give legal

recognition, Penalties and adjudication to any transaction which is done by electronic

way or use of internet

CO10: Students recognize the aim of Environmental Protection Act to protect from

pollution and maintaining ecological balance for sustainable development

- Teacher: VINOD PATTATHIL

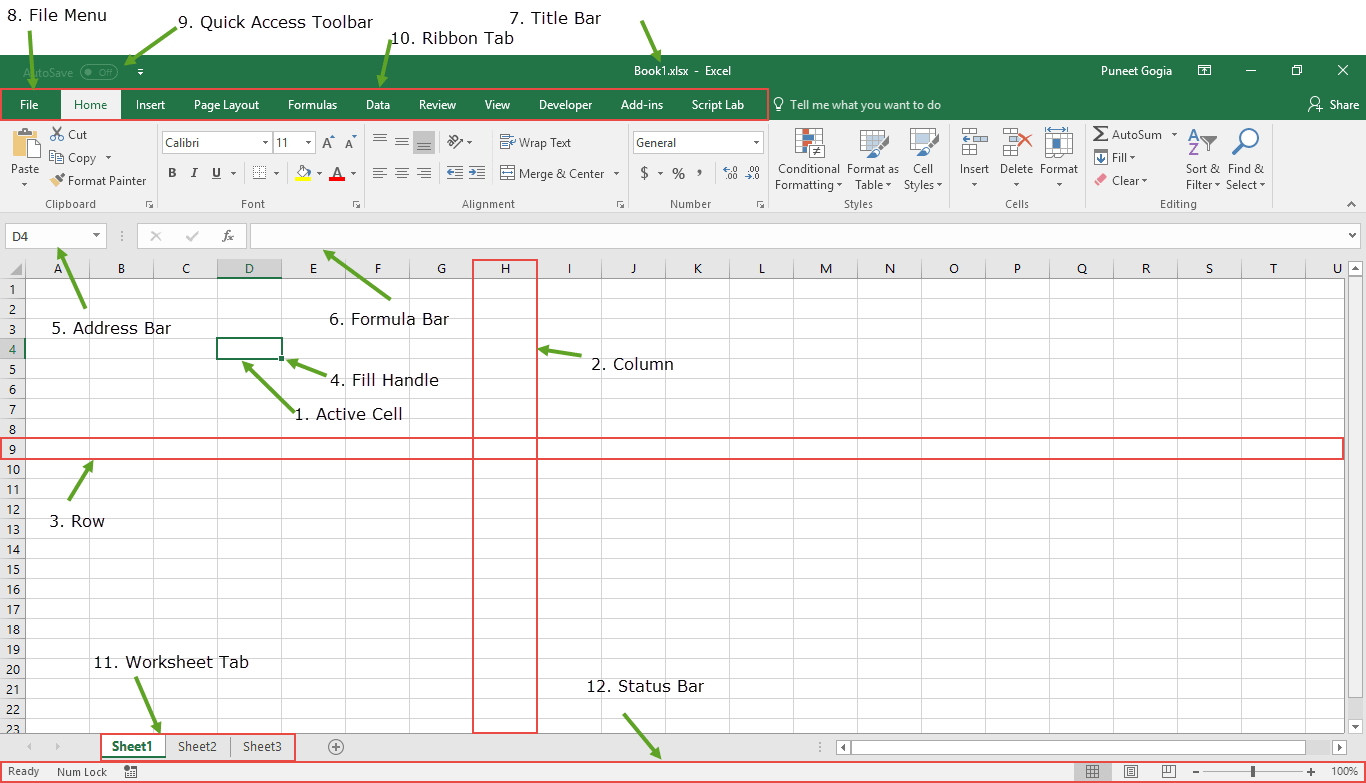

The course has been designed to make students equipped with M.S Excel as it is one of the widely used tools. Students will learn how to start working with M S Excel right from basics to Tables, Templates and Printing of their work.

Upon learning this course, learners can

CO1. Understand the importance of M.S. Excel in the real world.

CO2. Know about various shortcut keys in M.S. Excel.

CO3. Know about various formulas in M.S. Excel.

CO4. Know about data presentation techniques available in M.S. Excel.

CO5. Understand modelling techniques by Multi formulae techniques.

CO6. Know about protection techniques in M.S. Excel.

CO7. Know various templates provided by M.S. Excel.

CO8. Understand worksheet operations.

- Teacher: AMULYA VUNNAVA

Objective of this course is to develop skills required for web programming including mark-up and scripting languages. I Course includes use of DHTML , XML and JavaScript programming languages.

- Teacher: ANU VICTOR

Course Objective:

The course has been designed to make students equipped with M.S Excel as it is one of the widely used tools. Students will learn how to start working with M S Excel right from basics to Tables, Templates and Printing of their work.

Upon learning this course, learners can

CO1. Understand the importance of M.S. Excel in the real world.

CO2. Know about various shortcut keys in M.S. Excel.

CO3. Know about various formulas in M.S. Excel.

CO4. Know about data presentation techniques available in M.S. Excel.

CO5. Understand modelling techniques by Multi formulae techniques.

CO6. Know about protection techniques in M.S. Excel.

CO7. Know various templates provided by M.S. Excel.

CO8. Understand worksheet operations.

- Teacher: AMULYA VUNNAVA