Course description

BFS course deals with comprehensive structure of Indian banking industry and various fund based and non-fund based financial services offered by banking and non-banking financial institutions. This provides clear picture on understanding contextual obligations creating relationship between banker and customer including special types of customers. This provides knowledge about various negotiable instrument viz., BoE, cheques, promissory notes and precautions to be taken by banker while advancing loans.

- Teacher: Dr. KAVITA THAKUR

Cost accounting is designed to provide knowledge on cost concepts and types of cost and essentials of good cost accounting system. This deals with companies internal reporting relating to maintaining costing records viz. pricing methods and issue of materials to production, determining wages and apportionment and absorption of overheads. This imparts knowledge on preparation of cost sheet, determination of unit cost, job cost and accounting treatment of contract costing and process costing.

- Teacher: DEEPA AGRAWAL

ADVANCED ASPECTS OF INCOME TAX

| This course provides knowledge about of income tax and provisions relating to computation of income from business or profession and other provisions relating to clubbing and aggregation of income. This imparts practical knowledge on computation of tax liability and assessment procedure. |

- Teacher: Dr B SWATHI

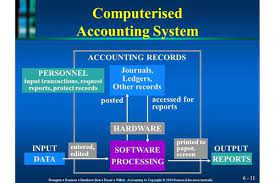

| Course Overview: Computerized accounting emphasizes on maintenance of accounting records electronically using Tally package. This imparts practical understanding about process of creating company, creating groups, ledgers recoding of accounting transactions in various vouchers. This provides how to maintain stock keeping units and evaluation as per the records of different godwon locations., item wise etc. This imparts knowledge on tracking of aging of various bills arising out of credit transactions. The improves the decision making skills with help of auto generated MIS reports viz., profit and loss account, balance sheet, cash flow and funds flow statement and ratio analysis. |

- Teacher: BIKSHAPATHI MADA

Course Description |

| Business Economics is designed to provide comprehensive understanding of economic concepts and principles which are useful in understanding the general economic environment within which businesses operate viz., demand analysis, supply analysis, production analysis and cost and revenue analysis. |

- Teacher: Dr. SRI SAI CHILUKURI

AUDITING

Course Description(DSE 503a) : Auditing is a 5 credit course with 60 sessions for the semester and 5 for revision totaling to 65 sessions.

Auditing

course deals with basics of audit and its types. It describes the auditing

standards described by AASB. It gives a thorough understanding on requirements

to be appointed as an auditor. It describes the audit procedures viz., internal

control, internal check, internal audit. it also deals with vouching of

transactions in EDP environment. It also emphasizes on verification and

valuation of various assets and liabilities.

- Teacher: Dr. SRI LAKSHMI RAMU