- Teacher: AMULYA VUNNAVA

| CO1 | Students apprehend the various products and their significance of General Insurance |

| CO2 | Students know the prospects of Indian and International General Insurance Market |

| CO3 | Students realize the statutory requirements and procedure to be followed while filling the various General Insurance policy forms and documents |

| CO4 | Students will understand the role of underwriters & Actuaries in fixing the premiums by Risk Sharing and Risk Management techniques |

| CO5 | Students understand the process and documents necessary for different types of claims. |

| CO6 | Students also learn about the frauds, fraud prevention and different types of reserves of Insurance Companies |

- Teacher: RUPINI B

|

Course Objective: |

|

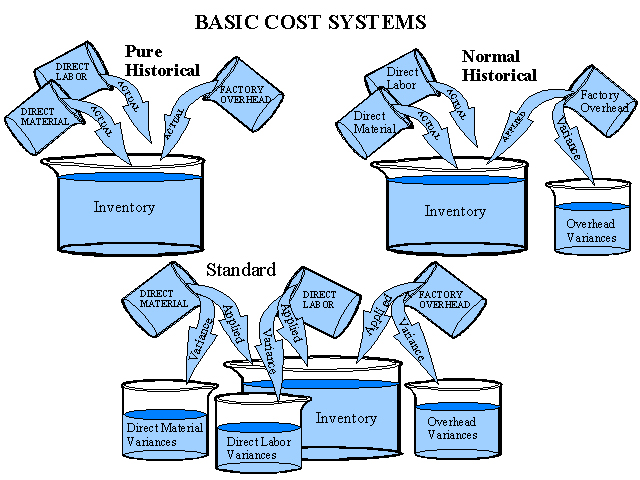

To make the students acquire the knowledge of cost accounting methods. |

|

Course Outcome: |

|

CO1) Express the place and role of cost accounting in the modern economic environment CO2) Identify the specifics of different costing methods. CO3) Apply Costing Concepts in their business and cost related areas. CO4) Emphasis will be placed upon the application of cost accounting theory in the solution of problems. CO5) Explain the similarities and differences between job order cost and process cost systems and determine who uses each. CO6) Apply activity-based costing to service industries. CO7) Appear confidently for Cost Accounting based college / Professional Course Examinations. |

UNIT-I: INTRODUCTION: Cost Accounting: Definition – Features – Objectives – Functions – Scope – Advantages and Limitations - Essentials of a good cost accounting system- Difference between Cost Accounting and Financial Accounting – Cost concepts – Cost Classification.

UNIT-II: MATERIAL: Direct and Indirect Material cost – Inventory Control Techniques – Stock Levels – EOQ – ABC Analysis – JIT - VED - FSND - Issue of Materials to Production – Pricing methods: FIFO - LIFO with Base Stock and Simple and Weighted Average methods.

UNIT-III: LABOUR AND OVERHEADS: Labour: Direct and Indirect Labour Cost – Methods of Payment of Wages (only Incentive Plans): Halsey, Rowan, Taylor Piece Rate and Merrick Multiple Piece Rate Methods. Overheads: Classification - Methods of Allocation - Apportionment and Absorption of overheads.

UNIT-IV: UNIT AND JOB COSTING: Unit Costing: Features - Cost Sheet – Tender and Estimated Cost Sheet. Job Costing: Features - Objectives – Procedure - Preparation of Job Cost Sheet.

UNIT-V: CONTRACT AND PROCESS COSTING: Contract Costing: Features – Advantages - Procedure of Contract Costing – Guidelines to Assess profit on incomplete Contracts. Process Costing: Meaning – Features – Preparation of Process Account – Normal and Abnormal Losses.

SUGGESTED READINGS: 1. Cost Accounting: Jain and Narang, Kalyani

2. Cost Accounting: Srihari Krishna Rao, Himalaya

3. Cost and Management Accounting: Prashanta Athma, Himalaya

4. Cost Accounting: Dr. G. Yogeshweran, PBP.

5. Cost Accounting: Jawaharlal, Tata Mcgraw Hill

6. Cost Accounting: Theory and Practice: Banerjee, PHI

7. Introduction to Cost Accounting: Tulsian, S.Chand

8. Cost Accounting: Horngren, Pearson

9. Cost Accounting: Ravi M. Kishore, Tax Mann Publications.

|

Instructions to the Students |

|

[1] Students are requested to be in class prior to the faculty entering into the class. [2] A late entry (After 5 Minutes of the prescribed session hour i.e., 300 Seconds) into the class is strictly prohibited. [3] Once session begins, students are not allowed to go outside; case is different for valid reason. [4] Students are advised to attend all sessions without fail (Maintain Minimum 75% Attendance). [5] Every day questions will be asked on the topics covered in earlier sessions, students should be prepared to give the answers. [6] Students are advised to carry Pen, Reader, Running Notes and Simple Calculators to each and every session compulsorily. [7] Students are requested not use Mobile Phones during the session. [8] If Student is found using Mobile Phones during the session, mobile will be confiscated and will be returned only at the end of the semester. Hence students are advised to give landline number of college information centre to their family members for emergency purpose. |

- Teacher: Dr. SRI SAI CHILUKURI

COURSE OBJECTIVE:

The course will help students to understand:

1) To acquire knowledge of working of Indian Banking system

2) The impact of government policy and regulations on the banking industry

3) Financial statements and performance of banks

4) Banking lending policies and procedures.

COURSE OUTCOMES:

At the end of the course, students should be able to:

C01 -Discuss the impact of government policy and regulations on the banking industry.

C02 -Evaluate the performance of the banking industry.

C03 -Discuss bank lending policies and procedures.

C04 -To elucidate the broad functions of banks

C05 - To understand the working of the Reserve Bank of India

C06 - To grasp the conduct of monetary policy and its effect on the interest rate, credit availability, prices, and the inflation rate

C07 - To express opinions about banking in written and oral form, based on the basic knowledge and skills acquired

C08 -To learn the importance to be updated on the developments of the banking sector and practice the same.

- Teacher: BIKSHAPATHI MADA