|

Course Description Computerized Accounting involves using computers and accounting packages for recording storing and analyzing financial data. Tally Software is a complete accounting, inventory, taxation and payroll software. It is one of the best and most commonly used software applicable for small business houses and big financial companies. Learning of computerized accounting makes the entire process of preparing financial accounts faster and simple. The Financial Statements and reports can be generated at the click of a button. It relives the accountants from routine and time consuming process of manual accounting. Financial Data processed through accounting software is easily accessible, accurate, reliable, cost effective and secure. |

|

Course Significance: Learning Computerized accounting is imperative for students seeking jobs in accounts department of any company. It gives the learner the required skills to carry out range of day-to-day accounting activities. Learning Tally also makes it easy to adapt to any other package designed for accounting. By learning the advanced features of Tally related to Taxation and payroll the candidates will be eligible for the posts of (in Government & Private) Assistant Clerks in Tax Departments, Junior Accountants in Companies, Corporations and Boards. Audit Assistant in co-operative departments. Office Assistant/ Accounts Clerk/Accounts Assistant/ Assistant Commercial Tax Practitioner, assistant income tax practitioner, Data Entry Operator, Entry level accounts analyst in BPO. |

|

Course Outcome: CO1) This course aims at providing Computerized Accounting skills to the students. CO2) The students will learn the procedure of transition of manual accounting to computerized accounting. CO3) The student will gain the competence to perform all basic functions of accounting, store details and manage inventory items. CO4) Students will be capable of using accounting software for business communication and accounting purposes. CO5) Students will be able to account for purchases and inventory transactions (creating purchase orders, handling invoices, maintaining inventory control) using a computerized accounting software package. CO6) Students will be able to account for customer and sales related events (maintaining and analyzing customer data, billing, bank deposits and accounts receivable) using a computerized accounting software package CO7) Will be able to ascertain profits and Financial position of the organization. CO8) Will be able to generate reports like Profit and Loss statement, Balance Sheet, Trial Balance, Cash-flow report, etc. and facilitate in decision making. |

CHAPTER II: MAINTAINING STOCK KEEPING UNITS (SKU): Introduction-Inventory Masters in ERP - Creating Inventory Masters-Creation of Stock GroupCreation of Units of Measure-Creation of Stock Item-Creation of Godown-Defining of Stock Opening Balance in ERP Stock Category-Reports.

CHAPTER III: RECORDING DAY-TO-DAY TRANSACTIONS IN ERP: Introduction-Business Transactions-Source Document for Voucher-Recording Transactions in ERP - Accounting Vouchers-Receipt Voucher (F6)-Contra Voucher (F4)-Payment Voucher (F5)-Purchase Voucher (F9)-Sales Voucher (F8)-Debit Note Voucher-Credit Note (Ctrl+F8)- Journal Voucher (F7).

CHAPTER IV: ACCOUNTS RECEIVABLE AND PAYABLE MANAGEMENT: Introduction-Accounts Payables and Receivables-Maintaining Bill-wise Details-Activation of Maintain Bill-wise Details Feature-New Reference-Against Reference-Advance-On AccountStock Category Report-Changing the Financial Year in ERP. CHAPTER V: MIS REPORTS: Introduction-Advantages of Management Information Systems-MIS Reports in ERP - Trial Balance - Balance Sheet-Profit and Loss Account-Cash Flow Statement-Ratio Analysis-Books and Reports - Day Book-Receipts and Payments-Purchase Register-Sales Register-Bills Receivable and Bills Payable.

REFERENCE BOOKS: 1. Computerised Accounting: Garima Agarwal, Himalaya

2. Computerised Accounting: A. Murali Krishna, Vaagdevi publications

3. Computerised Accounting: Dr. G. Yogeshweran, PBP.

4. Aakash Business Tools: Spoken Tutorial Project IIT Bombay

5. Mastering Tally: Dinesh Maidasani, Firewal Media

6. Implementing Tally ERP 9: A.K Nadhani and K.K Nadhani, BPB Publications

7. Computerised Accounting and Business Systems: Kalyani Publications

8.Manuals of Respective Accounting Packages

9.Tally ERP 9: J.S. Arora, Kalyani Publicatio

- Teacher: Dr. SRI SAI CHILUKURI

CO1:To make students understand about meaning and importance of law system in India

CO2:To make students learn about laws relatinG to business since every commerce student must have an idea about it

CO3: To make students aware about few important benchmark cases in law relating to business

CO4:To make students well acquainted about legal binding and legality

CO5:To help students make assignments on topics allotted to them

CO6:To develop a sense of moral judgements in students

CO7:To make student capable of deciding what is right and wrong

CO8:To help student understand in dealing in contracts and agreements

CO9:To make them understand about IPRs

CO10:To make them understand about identifying threats in business contracts

- Teacher: Dr. KIRTI SUNIL BIDNUR

Course Objective: To make acquaint of various types of General Insurance Products and their contribution in the economic development of a country.

Course Outcomes:

CO1: Students apprehend the various products and their significance of General Insurance

CO2: Students know the prospects of Indian and International General Insurance Market

CO3:Students realize the statutory requirements and procedure to be followed while filling the various General Insurance policy forms and documents

CO4:Students will understand the role of underwriters & Actuaries in fixing the premiums by Risk Sharing and Risk Management techniques

CO5: Students understand the process and documents necessary for different types of claims.

CO6: Students also learn about the frauds, fraud prevention and different types of reserves of Insurance Companies

- Teacher: JAYA LAXMI D

|

Course Description Computerized Accounting involves using computers and accounting packages for recording storing and analyzing financial data. Tally Software is a complete accounting, inventory, taxation and payroll software. It is one of the best and most commonly used software applicable for small business houses and big financial companies. Learning of computerized accounting makes the entire process of preparing financial accounts faster and simple. The Financial Statements and reports can be generated at the click of a button. It relives the accountants from routine and time consuming process of manual accounting. Financial Data processed through accounting software is easily accessible, accurate, reliable, cost effective and secure. |

|

Course Significance: Learning Computerized accounting is imperative for students seeking jobs in accounts department of any company. It gives the learner the required skills to carry out range of day-to-day accounting activities. Learning Tally also makes it easy to adapt to any other package designed for accounting. By learning the advanced features of Tally related to Taxation and payroll the candidates will be eligible for the posts of (in Government & Private) Assistant Clerks in Tax Departments, Junior Accountants in Companies, Corporations and Boards. Audit Assistant in co-operative departments. Office Assistant/ Accounts Clerk/Accounts Assistant/ Assistant Commercial Tax Practitioner, assistant income tax practitioner, Data Entry Operator, Entry level accounts analyst in BPO. |

|

Course Outcome: CO1) This course aims at providing Computerized Accounting skills to the students. CO2) The students will learn the procedure of transition of manual accounting to computerized accounting. CO3) The student will gain the competence to perform all basic functions of accounting, store details and manage inventory items. CO4) Students will be capable of using accounting software for business communication and accounting purposes. CO5) Students will be able to account for purchases and inventory transactions (creating purchase orders, handling invoices, maintaining inventory control) using a computerized accounting software package. CO6) Students will be able to account for customer and sales related events (maintaining and analyzing customer data, billing, bank deposits and accounts receivable) using a computerized accounting software package CO7) Will be able to ascertain profits and Financial position of the organization. CO8) Will be able to generate reports like Profit and Loss statement, Balance Sheet, Trial Balance, Cash-flow report, etc. and facilitate in decision making. |

CHAPTER II: MAINTAINING STOCK KEEPING UNITS (SKU): Introduction-Inventory Masters in ERP - Creating Inventory Masters-Creation of Stock GroupCreation of Units of Measure-Creation of Stock Item-Creation of Godown-Defining of Stock Opening Balance in ERP Stock Category-Reports.

CHAPTER III: RECORDING DAY-TO-DAY TRANSACTIONS IN ERP: Introduction-Business Transactions-Source Document for Voucher-Recording Transactions in ERP - Accounting Vouchers-Receipt Voucher (F6)-Contra Voucher (F4)-Payment Voucher (F5)-Purchase Voucher (F9)-Sales Voucher (F8)-Debit Note Voucher-Credit Note (Ctrl+F8)- Journal Voucher (F7).

CHAPTER IV: ACCOUNTS RECEIVABLE AND PAYABLE MANAGEMENT: Introduction-Accounts Payables and Receivables-Maintaining Bill-wise Details-Activation of Maintain Bill-wise Details Feature-New Reference-Against Reference-Advance-On AccountStock Category Report-Changing the Financial Year in ERP. CHAPTER V: MIS REPORTS: Introduction-Advantages of Management Information Systems-MIS Reports in ERP - Trial Balance - Balance Sheet-Profit and Loss Account-Cash Flow Statement-Ratio Analysis-Books and Reports - Day Book-Receipts and Payments-Purchase Register-Sales Register-Bills Receivable and Bills Payable.

REFERENCE BOOKS: 1. Computerised Accounting: Garima Agarwal, Himalaya

2. Computerised Accounting: A. Murali Krishna, Vaagdevi publications

3. Computerised Accounting: Dr. G. Yogeshweran, PBP.

4. Aakash Business Tools: Spoken Tutorial Project IIT Bombay

5. Mastering Tally: Dinesh Maidasani, Firewal Media

6. Implementing Tally ERP 9: A.K Nadhani and K.K Nadhani, BPB Publications

7. Computerised Accounting and Business Systems: Kalyani Publications

8.Manuals of Respective Accounting Packages

9.Tally ERP 9: J.S. Arora, Kalyani Publicatio

- Teacher: Dr. SRI SAI CHILUKURI

| CO1 | Express the place and role of cost accounting in the modern economic environment |

| CO2 | Identify the specifics of different costing methods. |

| CO3 | Apply Costing Concepts in their business and cost related areas. |

| CO4 | Emphasis will be placed upon the application of cost accounting theory in the solution of problems. |

| CO5 | Explain the similarities and differences between job order cost and process cost systems and determine who uses each. |

| CO6 | Apply activity-based costing to service industries. |

| CO7 | Appear confidently for Cost Accounting based college / Professional Course Examinations. |

- Teacher: RUPINI B

| Academic Year: | 2019-20 |

| Semester: | Semester 5 |

| Course Code: | BCAS 506 |

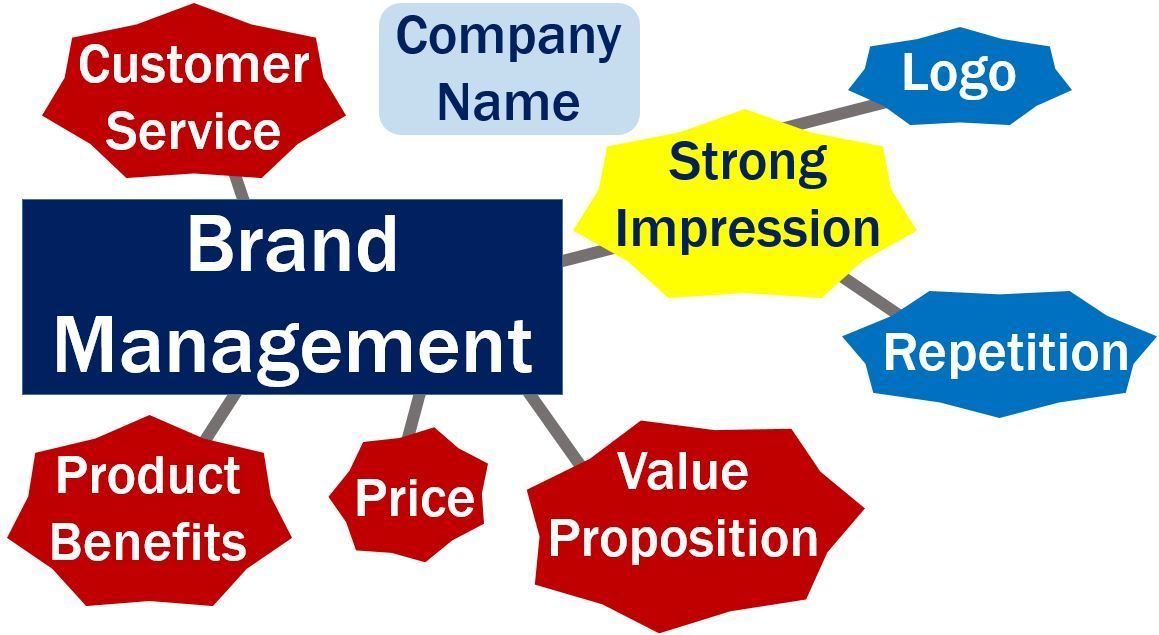

| Title: | Brand Management |

| Instructor: | GISA GEORGE |

| CO1 | Learn what is branding their concepts , functions and significance and different types of brands companies use. |

| CO2 | Learn the process of strategic brand management,how marketers use different ways to build a strong brand |

| CO3 | How they position their brands and establishing brand values learn what is brand vision and elements. Branding for global markets and competion with foreign brands. |

| CO4 | Branding for global markets and competion with foreign brands. |

| CO5 | Understand the different ways the brand image is build by the companys for their different products. |

| CO6 | Know the Programmes held for brand loyalty and Methods used for brand promotion. |

| CO7 | Understand what is brand extension, adopyion practices, learn the different types of brand extensions, factors influencing decisions |

| CO8 | Learn what is measuring brand performance,brand equity and its management. |

- Teacher: GISA GEORGE